This week, the total inventory of construction steel continued to decline, with the total rebar inventory down 2.43% WoW and the total wire rod inventory down 9.97% WoW. Supply side, the profitability of blast furnace steel mills remains moderate, with no strong willingness to cut production. According to the SMM weekly maintenance survey, the impact of maintenance on building materials this week was 1.1378 million mt, an increase of 24,000 mt WoW. In terms of EAF steel mills, the operating conditions of electric furnaces in different regions have diverged. In south China, a new electric furnace was added for maintenance due to profitability issues, while in central and southwest China, two electric furnaces resumed production as planned, driving the daily average production of electric furnaces up by 2,400 mt WoW. Overall, the supply remains relatively stable. Demand side, affected by the weakening of the futures market, speculative procurement in the market decreased significantly WoW, with terminal procurement mainly focused on just-in-time procurement. Overall, under the weak balance of supply and demand, the inventory of construction steel continues to decline, with the rate of decline slightly narrowing.

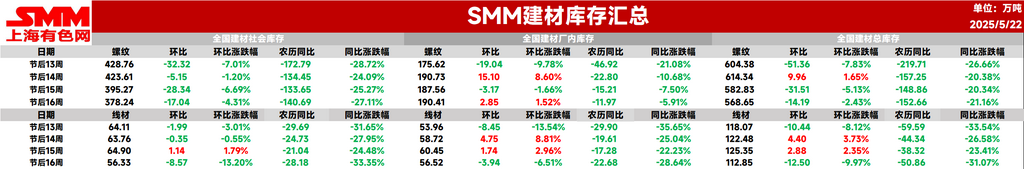

This week, the total rebar inventory was 5.6865 million mt, down 141,900 mt WoW, a decline of 2.43% (previous value: -5.13%), and a decrease of 1.5266 million mt compared to the same period last year, a decline of 21.16% (previous value: -20.34%).

Table 1: Overview of Rebar Inventory

Data Source: SMM

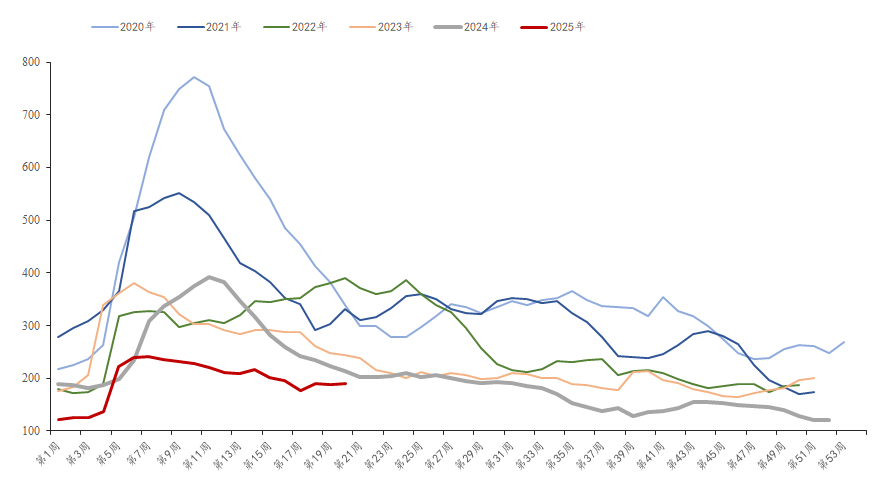

This week, the in-plant inventory of rebar was 1.9041 million mt, an increase of 28,500 mt WoW, a rise of 1.52% (previous value: -1.66%), and a decrease of 119,700 mt YoY, a YoY decline of 5.91% (previous value: -7.50%). The sentiment boost brought by the temporary easing of Sino-US trade friction has gradually faded, and the futures market has returned to weakness, with the price center of spot and futures prices shifting downward. Agents are mostly cautious and wait-and-see about the future market, with low enthusiasm for purchasing, leading to a slight accumulation of factory inventory.

Chart 1: Trend of Rebar Factory Inventory, 2020-2025

Data Source: SMM

This week, the social inventory of rebar was 3.7824 million mt, down 170,400 mt WoW, a decline of 4.31% (previous value: -6.69%), and a decrease of 1.4069 million mt YoY, a YoY decline of 27.11% (previous value: -25.27%). This week, traders' sentiment weakened, and their enthusiasm for stockpiling slowed down, while terminal construction sites maintained just-in-time procurement, driving a slight decline in social inventory.

Chart 2: Trend of Rebar Social Inventory, 2021-2025

Data Source: SMM

Looking ahead, most blast furnace steel mills still have profits, and their willingness to produce remains moderate, maintaining normal production levels. EAF steel mills are limited by the difficulty in collecting steel scrap and mostly maintain production during off-peak hours, with limited upward incremental space. Overall, the supply is expected to remain stable. Demand side, considering that many areas in south China are entering a rainy period, and north China is experiencing widespread high temperatures, the start of downstream construction sites may be hindered, and the sustainability of end-use demand is insufficient. Therefore, it is expected that the decline in building materials inventory may continue to narrow next week.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)